Legality Of Trading With Exness

In recent years, online trading has gained immense popularity, providing individuals with the opportunity to invest in various financial assets. Among the platforms available, Exness has emerged as a significant player in the market. However, with the proliferation of online trading platforms, questions surrounding the legality of trading with Exness arise. This article aims to explore the legal aspects of trading with Exness, including regulatory compliance, the jurisdictions in which it operates, and the implications for traders. For additional insights, you can read more at Legality Of Trading With Exness https://trading-bd.com/is-exness-legal-in-bangladesh/.

What Is Exness?

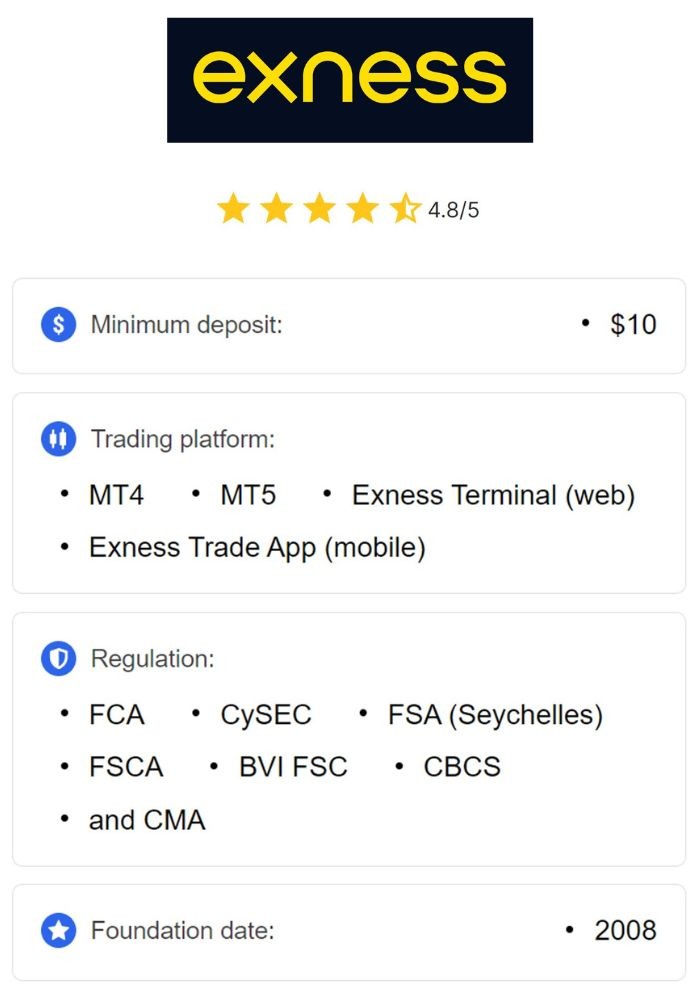

Founded in 2008, Exness is a global brokerage firm that offers trading in foreign exchange (Forex), commodities, cryptocurrencies, stocks, and indices. The platform has gained a reputation for its transparency, competitive spreads, and user-friendly interface. With its robust trading portfolio, Exness has attracted millions of traders from around the world. The firm operates under several regulatory authorities, enhancing its credibility in the financial markets.

Regulation and Licensing

One of the key factors determining the legality of trading with any broker is its regulatory compliance. Exness holds licenses from multiple regulatory authorities, which is a strong indicator of its legitimacy. Some of the crucial regulatory bodies that oversee Exness include:

- Financial Services Authority (FSA) of Seychelles: Exness is licensed under FSA Seychelles, which allows the company to operate in regions where regulations are more flexible.

- Cyprus Securities and Exchange Commission (CySEC): In the European Union, Exness is regulated by CySEC, which mandates strict adherence to financial regulations, ensuring traders’ funds and data are protected.

- Financial Conduct Authority (FCA): Although Exness is not directly regulated by the FCA, it adheres to UK laws and standards, ensuring that it maintains high levels of compliance.

Legal Status in Different Jurisdictions

The legality of trading with Exness varies based on the trader’s country of residence. Here are a few notable examples:

1. European Union

Traders within the European Union can trade with Exness under its CySEC license. The regulatory environment in the EU is robust, offering a high level of protection to investors. As a result, trading with Exness in this region is considered legal and secure.

2. Asia

In Asia, the situation is more nuanced. Some countries have strict regulations regarding forex trading, while others have more lenient policies. For instance, trading with Exness is popular in regions like Malaysia and Singapore, where traders appreciate the platform’s low spreads and diverse trading instruments. However, it’s essential to note that some countries, like Indonesia, have imposed restrictions on forex trading, making it crucial for traders to research their local laws before engaging with Exness.

3. United States

In the United States, the legality of trading with Exness is complicated. The U.S. has stringent regulations governing forex brokers, and as Exness is not registered with the Commodity Futures Trading Commission (CFTC) or a member of the National Futures Association (NFA), it cannot legally offer services to U.S. residents. Therefore, U.S. citizens should look for brokers that are licensed and regulated within the country.

Account Types and Features

Exness offers various account types to cater to different trading styles and preferences. Each account type comes with unique features, spreads, and leverages. Some popular account types include:

- Standard Account: Ideal for beginner traders, this account type offers competitive spreads and no commission on trades.

- Pro Account: Suitable for professional traders, the Pro account provides tighter spreads and a small commission for each trade.

- Zero Spread Account: Designed for scalpers and high-frequency traders, this account type has zero spreads and a commission on trades.

Safety Measures and Risk Management

Exness prioritizes the safety of its traders by implementing various risk management and security measures. The company employs robust encryption technology to protect clients’ sensitive information and ensures segregated accounts for clients’ funds, safeguarding them against financial instability.

Additionally, Exness offers negative balance protection, ensuring that traders cannot lose more than their initial investment. This safety feature is especially beneficial for inexperienced traders who may face challenges in managing risk.

Conclusion

In conclusion, the legality of trading with Exness largely depends on the trader’s jurisdiction and the applicable regulations in that area. Exness operates under multiple licenses, providing a level of assurance regarding its legitimacy. However, traders must remain vigilant and conduct their own research to ensure compliance with local laws. By understanding the regulations and safety measures associated with trading on platforms like Exness, traders can make informed decisions in their investment journey.