External factors like technological developments, provide and demand, and economic circumstances also impact salvage value, making market analysis a vital part of the calculation. These tools require inputs like an asset’s authentic price, useful life, and estimated depreciation price to provide a quick salvage worth estimate. They provide a convenient method to simplify complicated calculations for better financial planning.

What Is The Double-declining Steadiness (ddb) Depreciation Method?

The common remaining useful life for present PP&E and useful life assumptions by management salvage value depreciation formula (or a tough approximation) are needed variables for projecting new Capex. In specific, firms that are publicly traded understand that traders out there may understand decrease profitability negatively. Sure, however you’ll need IRS approval for the change and must replace your accounting information accordingly. Anne Wiegand is a seasoned writer with a ardour for sharing insightful commentary on the world of finance.

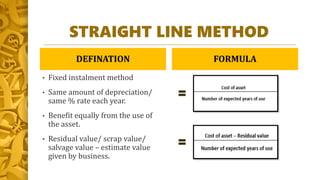

Straight Line Depreciation Method

In this technique, the businesses expense twice the amount of the guide worth of the asset annually. While there are various methods to calculate depreciation, three of them are more generally used. Rodolfo West is a seasoned author with a ardour for crafting informative and interesting content material. Salvage worth refers to the expected money worth of an asset on the finish of its helpful life. It’s also referred to as residual value, representing the asset’s worth after its useful lifespan.

Assume that our firm has an asset with an initial price of $50,000, a salvage value of $10,000, and a useful life of 5 years and 3,000 units, as shown in the screenshot below. Our job is to create a depreciation schedule for the asset using all 4 types of depreciation. A. There are many ways to calculate depreciation in Excel, and a variety of other of the depreciation strategies already have a built-in perform included in the software program. The desk beneath includes all of the built-in Excel depreciation strategies included in Excel 365, along with the formulation for calculating units-of-production depreciation. Depreciation is a crucial idea in accounting, and it’s used to calculate the lower in value of belongings over time. By understanding depreciation and salvage worth, companies can make informed selections about asset disposal and salvage value.

Double-declining Stability Technique

- The salvage value equation is a mathematical method used to calculate the residual value of an asset after its useful life has ended.

- These costs embrace the expenses for dismantling, removing, and transporting the asset, which could be substantial.

- For instance, a automotive may have a helpful lifetime of 5-7 years, while a bit of heavy gear could last years.

- For instance, understanding the salvage value helps determine the optimum level to promote or retire an asset earlier than its operational costs outweigh its benefits.

Companies use straight-line depreciation in on a regular basis situations to calculate the width of business belongings. To get a better understanding of the means to calculate straight-line depreciation, let’s take a glance at an instance. Moreover, the IRS allows companies to put in writing off sure expenses utilizing this technique underneath the Modified Accelerated Price Recovery System (MACRS). Accurately forecasting depreciation patterns and their effect on salvage worth is difficult.

Double-declining Steadiness

Whereas technically more “accurate”, no less than in theory, the items of production technique is essentially the most tedious out of the three and requires a granular analysis (and per-unit tracking). We now have the necessary inputs to construct our accelerated depreciation schedule. Market demand for similar belongings affects their resale price, with larger demand usually resulting in a better salvage value, influencing the asset’s value at the end of its useful life. To calculate the after-tax salvage worth, subtract the e-book value from the promoting worth to search out the gain, multiply the acquire by the tax fee, and then subtract the tax from the selling worth.

There are different strategies of depreciation in addition to straight line, and so they’re used to achieve tax or cash flow advantages. In accounting and tax, salvage worth is used to calculate the total depreciation expense over the asset’s useful life. The salvage worth is subtracted from the asset’s unique cost to find out the entire amount of depreciation. Fortunately or unfortunately, it’d occur in order that the administration is able to https://www.kelleysbookkeeping.com/ get significantly more for the fixed asset than what is said on their accounting books. Since the income a enterprise receives is taxable, the legislation requires businesses to pay taxes on the amount obtained on prime of the residual value.